Convenience and risk all with the swipe of the wrist. Credit cards are a tool that many of us use in order to buy things in a convenient fashion, eliminating the need to carry cash. When used properly this tool can add value to our financial lives. Credit cards offer the ability to buy things now and pay later, build credit and accumulate rewards. However, they can also be used to accumulate debt, huge interest costs, and put you in a financial hole if not managed properly.

Recently, when sitting with a client they shared with us the situation their mother was in and I saw the need to share this information. The client was working with their mother in order to obtain a mortgage for a new home. As far as the kids knew mom should be in a good position to obtain a mortgage, but unfortunately the mortgage was declined. When they investigated further, it was discovered that mom had significant credit card balances which were having a detrimental effect on her debt to income ratio. The children approached their mom and asked her why she was carrying these balances and she explained that she was told her credit score would benefit from having an outstanding balance on her credit cards.

Luckily the children were aware that this was not the case and she was most likely causing a negative effect on her credit score, not to mention the significant interest expenses she was incurring. Mom is lucky to have her children on her side as they are working with her to become debt free and educate her on what the “truths” are regarding credit cards.

This experience ignited the need for me to help bring to light the truth about credit cards. Here are five credit card myths that may be hurting your financial future.

Here are five credit card myths that may be hurting your financial future.

Carrying a balance on my credit card will help my credit score. This is a complete myth and will actually do the opposite, it will hurt your score. The credit bureaus want to see that you can pay your debts and do so on time. The best way to utilize a credit card is to simply pay off the balance each month. This demonstrates that you have the ability to take on manageable debt and pay it off on time. There may be instances where you cannot pay in full and you will want to pay at least the minimum payment. It is always vital to pay on time, paying late will certainly hurt your credit score. Bottom line, not paying your credit card in full because you believe it is helping your credit score is incorrect and you should develop a plan to correct this.

You should not have a credit card and only use a debit card. This myth was born from the idea that with a debit card you will only be able to spend what you have, where with a credit card you can accumulate debt beyond what you may have saved. Though this thought process makes sense credit cards tend to be safer. We are living at a time where data breaches and fraud is on the rise. It is true that both debit and credit cards offer protections against these issues, but credit cards tend to have stronger protections for the card holder. Should you have a fraud while using a debit card (even if you are swiping it as a credit card) the funds could be taken out of your bank account and it may take your bank a few weeks to clear it up. This could tie up the funds in your account and even result in bounced checks or insufficient funds while the fraud is investigated. Fraud on a credit card is not going to cause an issue with your bank accounts as they perform an investigation. Also credit cards often provide additional protections for your purchases that debit cards typically do not.

Interest begins to accrue right after my credit card purchase. This is another complete myth with no truth behind it. It is true that credit cards can come with significant interest rates attached to them, but they do not start accumulating until after your payment is due. Essentially by paying your bill on time, you will not incur any interest expense and the credit card will simply provide you with an interest free loan from the date of purchase until the payment is due. This is the ideal way to use a credit card for the consumer, not the ideal outcome for the credit card company.

Never pay an annual fee for a credit card. Paying an annual fee for a credit card is not necessarily a bad thing. This is a personal choice and you need to evaluate the cost benefit of the fee. Many cards available today have tremendous benefits attached to them. There are cards available that provide you with anything from additional purchase insurance or warranty coverage, airline credits, internet access on flights, baggage fees, travel insurance, access to premier lounges, access to a concierge, and many other benefits. You need to review what the benefits are, evaluate whether you will use them and decide if the card is worth the expense. The benefits for many consumers outweigh the cost.

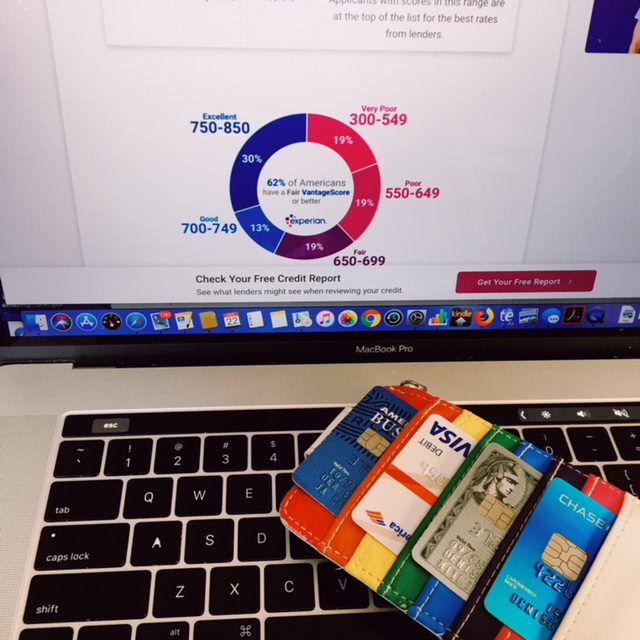

Having too many credit cards will hurt my credit score. This is another common myth and having several cards can actually help your credit. The credit bureaus will look at the amount of credit you have available and how you are using it. Your score can benefit by having a lower utilization of a higher credit amount. One caveat here, this may not hurt your credit, but it may present a hurdle when obtaining a mortgage. The mortgage company will love your higher score, but they will not be fond of you having access to a larger pool of credit and this could present a challenge. The number of credit cards you have, or will want to have, may depend on the stage of life you are in and what your goals are at the time.

Credit cards can provide you with a great way to pay for things, build credit and ensure against fraud, but there are many myths out there and it is important to understand the facts. We have outlined what we believe to be the top five myths we have seen, but there are many more. It is critical to educate yourself on what is fact and what is myth. You will want to use credit cards in a way that they will enhance and not hinder your financial future.

Mitlin Financial assists our clients in addressing these myths and we would be more than happy to assist you with any questions. Feel free to contact us, Mitlin Financial, at (844) 4-MITLIN x12 if you or someone in your family needs assistance in debunking credit card myths.

This article represents the opinion of Mitlin Financial Inc. It should not be construed as providing investment, legal and/or tax advice.